|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

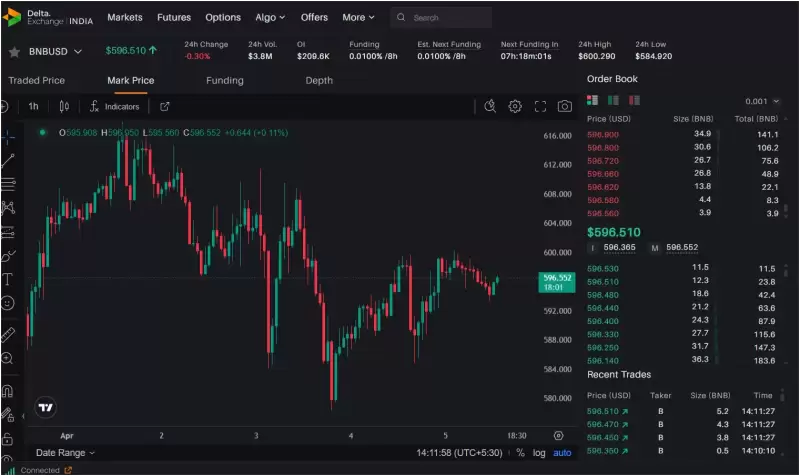

Bitcoin (BTC) Trading Activities Have Been Recording High Volatility Over the Weekend

Apr 12, 2025 at 09:00 pm

After a long time of speculations, Bitcoin (BTC) trading activities have been recording high volatility over the weekend. The continuous six weekends in a row

After a long time of speculations, Bitcoin (BTC) trading activities have been recording high volatility over the weekend. The continuous six weekends in a row have shown that BTC has formed a certain price gap, which may indicate increased investor activity.

However, some members of the crypto community believe that these weekend surges may be a ploy by institutions to get traders focused in the wrong direction.

After a six-weekend pattern of surging during the weekend and then pulling back early in the subsequent week, it appears that the market is beginning to respond to some of the moves.

Daan Crypto Trades mentioned that it is not rare to observe such a pattern with weekend moves. Nevertheless, these patterns of movement have been reversing early in the subsequent week as much as short-term movements have been thrilling. He noted that it is dangerous to focus on just weekend price action, especially if the moves carry forward to Monday or Tuesday.

This behaviour remains consistent and paints a picture of how the market outlook has changed over time by having traders respond loudly during off-peak periods to certain headlines and news. In the same way, Bitcoin is trying to sustain several key support levels that could provide the foundation for a more significant move if the rate is maintained through the week.

In support of this bull’s argument, More Crypto Online pointed out that Bitcoin’s breakout above Wednesday’s high invalidates a bearish impulsive wave (5). However, a corrective wave (4) is still possible but is gradually becoming less probable.

He also pointed out that although that is far from clear in the short term, a more bullish setup could be in the offing. While the BTC /USD price is trading above the technical level of $79,657, the medium-term outlook will remain bullish. It is considered the level that, once breached, could lead towards achieving the target of $94,000.

Momentum Builds Toward $94K

Now traders are concentrating on how Bitcoin behaves at the various time segments of a day. While the fluctuation is prominent only on the weekends, traders should be evaluated during normal trading days when price movements are much more consistent. A bullish breakout above $88,000 will most probably spur the bulls towards $94,000.

Long-term coin holders are beginning to accumulate more of the coin, and funding rates have stabilized. Although the situation is still considered somewhat risky, the pattern for further activity has started to develop. Whether Bitcoin is set to start a new up leg will depend on the stability of this momentum.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Virtual Magnet Motor Innovator Volektra Raises New Funding to Commercialize Its Technology

- Apr 13, 2025 at 05:10 am

- Electric drivetrain innovator Volektra has secured a new funding round to commercialize its proprietary Virtual Magnet motor technology–an industry-first breakthrough that eliminates rare earth magnets

-

-

-

-

-

-

-

![Bitcoin [BTC] has followed that pattern, with a 3.22% rally during this period. This seemed to indicate that market confidence is growing. Bitcoin [BTC] has followed that pattern, with a 3.22% rally during this period. This seemed to indicate that market confidence is growing.](/assets/pc/images/moren/280_160.png)

- Bitcoin [BTC] has followed that pattern, with a 3.22% rally during this period. This seemed to indicate that market confidence is growing.

- Apr 13, 2025 at 04:50 am

- As the cryptocurrency market gains ground, Bitcoin [BTC] has followed that pattern, with a 3.22% rally during this period. This seemed to indicate that market confidence is growing.

![Bitcoin [BTC] has followed that pattern, with a 3.22% rally during this period. This seemed to indicate that market confidence is growing. Bitcoin [BTC] has followed that pattern, with a 3.22% rally during this period. This seemed to indicate that market confidence is growing.](/uploads/2025/04/13/cryptocurrencies-news/articles/bitcoin-btc-pattern-rally-period-market-confidence-growing/middle_800_480.webp)