Last week, Bitcoin surpassed the threshold of $69,000 before experiencing a slight pullback. This surge, much more than just a simple spike in volatility

Last week, Bitcoin crossed the threshold of $69,000 before undergoing a slight pullback. This surge, more than just a simple spike in volatility, can be attributed to a combination of crucial technical indicators and unprecedented institutional interest.

As reported by blockchain analytics firm Glassnode, the cryptocurrency managed to cross key technical thresholds, such as the 200-day and 111-day moving averages, which are closely followed by technical analysts. This move, coupled with massive capital inflows into the Bitcoin market, seems to be ushering in a phase of maturity, marked by an unparalleled level of liquidity.

Technical indicators confirm a renewal of the trend

Indeed, over the last 30 days, net capital inflows into the Bitcoin asset have increased by $21.8 billion, representing a rise of 3.3%, which has pushed the Realized Cap to a new high of $646 billion. This figure represents an important indicator of increasing liquidity in the market, reinforcing the idea that this recovery is supported by real investments and not simply by speculation. Thus, these indicators reflect a market dynamic that rests on solid foundations.

According to Ryan Lee, Chief Analyst at Bitget Research, another key event could have an impact on the price of BTC:

“Microsoft’s Potential BTC Purchase: A significant potential market driver, Microsoft has proposed purchasing BTC, pending board approval. If approved, this would be highly favorable for the market.”

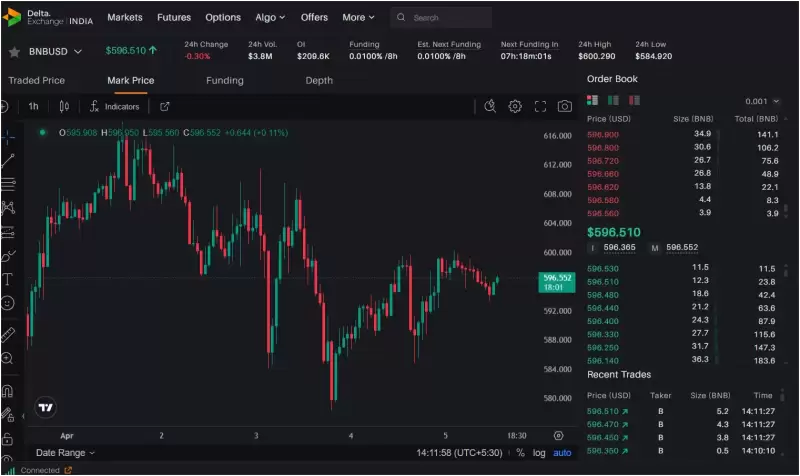

The impact of institutional interest on futures contracts

Alongside technical indicators, the growing interest from institutions plays a crucial role in the recent price surge. Glassnode highlights that the open positions on Bitcoin futures have reached a historic peak of $32.9 billion, largely due to the involvement of institutional players via the Chicago Mercantile Exchange (CME). “The increased participation of institutions, combined with sophisticated hedging strategies like cash-and-carry, enhances market stability,” notes Glassnode. Indeed, the annualized return of these strategies is estimated at around 9.6%, nearly double the yields offered by short-term U.S. Treasury bonds, explaining why institutions continue to flock to this market.

This rally may well be just the beginning of a longer trend. While the involvement of short-term investors shows signs of encouragement with unrealized profits, it is mainly institutional commitment that could solidify this momentum in the long run. The growing interest in hedging strategies and derivatives suggests that Bitcoin is on its way to becoming a true asset class for large financial institutions, further strengthening its position in the global economic landscape.