|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin (BTC) Rides a Wave of Optimism, Holding Steady Near $80,000 as the Fed Maintains Rates

Mar 20, 2025 at 07:00 pm

Bitcoin has been riding a wave of optimism, holding steady near $86,000 following a dovish Federal Reserve meeting. The Fed's decision to maintain

Bitcoin rose more than 2% on Thursday, consolidating above $85,000 as the Federal Reserve maintained interest rates and signaled potential cuts by the end of 2025.

What Happened: The Fed’s decision to keep rates in the 5.00%-5.25% range for the third quarter of 2023 and hint at a 0.25 percentage point reduction by December in its Summary of Economic Projections sparked fresh momentum in the crypto market.

While the projections showed a median increase in the federal funds rate to 3.875% by the fourth quarter of 2024, the dot plot also indicated that two more rate cuts could be implemented by the end of 2025.

"We're really planning to go meeting by meeting, and to try to make assessments of the incoming economic data and the balance of risks, and to be clear, we're not pre-committing to cutting the federal funds rate this year," Fed Chair Jerome Powell said in his press conference following the meeting.

Bitcoin price surged to a two-week high of nearly $87,500, indicating renewed investor confidence. The cryptocurrency is trading at $85,084, showing an increase of 2.47% over the past 24 hours.

Why It's Important: A shift from aggressive quantitative tightening (QT) could create a more favorable environment for Bitcoin and other digital assets.

"The Fed signaled that it could slow the pace of balance-sheet reduction starting in April, which bodes well for crypto considering that looser liquidity conditions have historically benefited cryptocurrencies," ING economists said in a note.

"This signals that the correlation between macroeconomic policies and crypto prices, which has become increasingly evident in recent times, is likely to continue in the coming months."

Adding to the optimism, rumors of a significant update to U.S. crypto policy have further fueled market enthusiasm. Speculation about potential regulatory changes has traders eyeing the $90,000 mark as the next psychological milestone for BTC.

"The crypto market is heating up again as rumors of a significant update to U.S. crypto policy continue to swirl. With the potential for new regulations and a shift in the macroeconomic landscape, traders are anticipating BTC to hit $90K after a brief pullback from the $88K resistance level," Ben Armstrong, a crypto influencer known as "The Armstrong Effect," said.

Challenges Arise: However, challenges remain as persistent inflation concerns and economic uncertainty could introduce volatility in the coming months.

"While Bitcoin's recent performance is encouraging, it may face resistance as it approaches higher price levels, and any substantial decline could have broader implications for the crypto market," Armstrong added.

The broader crypto market has also shown resilience, with altcoins like Ethereum and Solana posting gains. Nonetheless, the sustainability of this rally will depend on a combination of macroeconomic factors and market dynamics.

As Bitcoin consolidates near the $86,000 mark, the question remains: can it sustain its upward trajectory? With the Fed signaling a more accommodative stance and market participants anticipating regulatory clarity, the stage is set for potential growth. However, investors should remain vigilant as the path forward is likely to be shaped by both opportunities and challenges in the evolving crypto landscape.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Singapore's Schools Need to Do More to Foster Inclusivity

- Apr 22, 2025 at 09:50 am

- Many schools in Singapore allow students on the mild end of the autism spectrum to join mainstream classes – a commendable effort to promote inclusivity. However, true inclusivity demands more than mere physical presence – it requires a classroom culture of understanding

-

-

- The Bank of Korea (BOK) has decided to take an active role in shaping South Korea's regulatory framework for stablecoins.

- Apr 22, 2025 at 09:45 am

- This move comes as the central bank grows increasingly concerned about the risks these digital assets may pose to the country's monetary and financial systems.

-

- Meteora Labs sued by investors over alleged M3M3 token price manipulation

- Apr 22, 2025 at 09:40 am

- A group of investors has filed a class-action lawsuit against decentralized cryptocurrency exchange Meteora, alleging the firm was involved in manipulating the launch and market price of the M3M3 token.

-

- This is a published version of our weekly Forbes Crypto Confidential newsletter. Sign up here to get Crypto Confidential days earlier free in your inbox.

- Apr 22, 2025 at 09:40 am

- Just last week, Mantra’s OM token looked great: up over 800% year‑on‑year, a fresh $108 million ecosystem fund and a $1 billion Dubai real‑estate deal

-

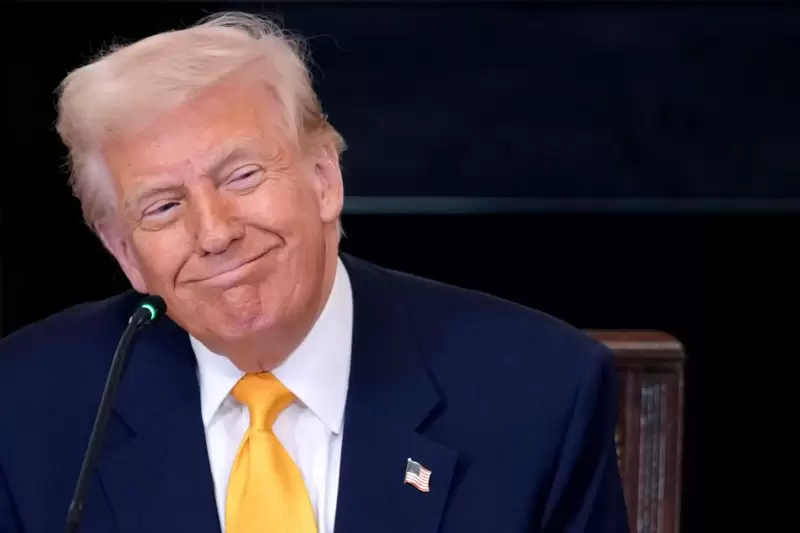

- Trump Token Unlocks Are When a Group of People—Usually Project Team Members, Early Investors or Advisors—Receive Their Allocated Tokens

- Apr 22, 2025 at 09:35 am

- Token unlocks are when a group of people—usually project team members, early investors or advisors—receive their allocated tokens for free or at a lower price

-

- Meme cryptocurrency Dogecoin is currently trading at an important support level against Bitcoin

- Apr 22, 2025 at 09:35 am

- This significant observation comes from crypto analyst MasterAnanda, whose latest technical analysis on the TradingView platform highlights the potential for another major Dogecoin rally

-

- Dogecoin (DOGE) Price Broke Out of Two Technical Patterns, Setting the Stage for a Bullish Run

- Apr 22, 2025 at 09:30 am

- Dogecoin price signaled a bullish reversal after breaking out of two critical technical patterns this week. The market breakout created fresh expectations as analysts predicted DOGE price could reach between $0.20 and $0.29.