|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin (BTC) Price Outlook Drags Crypto Stocks Down

Oct 22, 2024 at 07:41 am

Bitcoin is stuck in the same flat-to-down price channel it picked up since reaching a record high of $73,750 seven months ago.

Bitcoin (CRYPTO: BTC) lost steam in recent days, dragging crypto stocks down with it.

What Happened: Bitcoin has been trading in a flat-to-down price channel since hitting a record high of $73,750 seven months ago.

The last time Bitcoin approached the $70,000 level was in late July. After a few days, Bitcoin crashed to less than $52,000.

At the time of writing, BTC’s price was $67,137, down 2.05% in the last 24 hours. Bitcoin’s recent price action showed a substantial decline from previous records.

In the current cycle, BTC rose to as high as $69,499, with some analysts even predicting the price to reach $70,655.

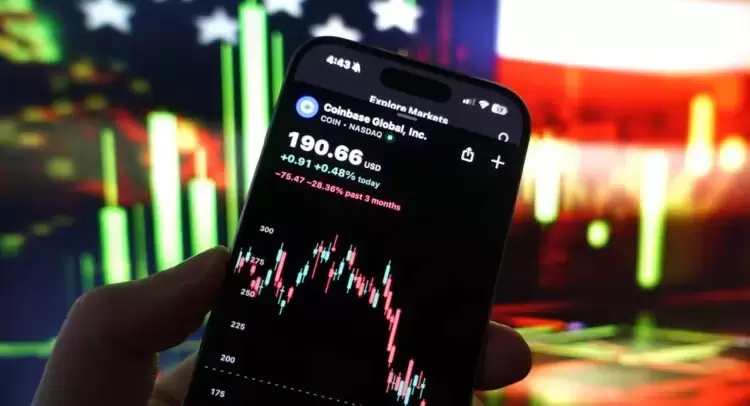

The ripple effect of Bitcoin’s price drop hit crypto stocks hard. In the last 24 hours, crypto stocks such as Coinbase (NASDAQ:COIN), MicroStrategy (NASDAQ:MSTR) and others recorded a decrease in price.

While COIN lost 4.6% of its value, MSTR dropped by 2.4% in just 24 hours.

Other crypto stocks that were affected by Bitcoin’s decreasing price include Bitfarms (NASDAQ:BITF), Riot Platforms (NASDAQ:RIOT), Hut 8 Corp (NASDAQ:HUT) and Marathon Digital (NASDAQ:MARA).

Bitfarms was down by 2.5%, Riot by 4%, HUT by 3.2% and MARA by 5%.

See More: Best Cryptocurrency Scanners

Cryptos Today: According to current market data, the global crypto market plunged by 1.93% to $2.32 trillion.

From a broader market perspective, top assets such as Ethereum (CRYPTO: ETH), Cardano (CRYPTO: ADA) and BNB showed a muted outlook.

One exception was Solana (CRYPTO: SOL), which recorded a 3.7% gain to $165, although it remained below its $170 peak over the weekend.

Possible catalysts for today's market movements include a sharp increase in interest rates across Western economies.

Specifically, the US 10-Year Treasury yield and the German 10-Year Bund yield both rose by 10 basis points.

Generally, crypto prices are impacted by the same directional sentiment that influences retail stock investors.

When rates increase, mainly due to monetary tightening to combat inflation, the cost of capital tends to rise.

As a result, risk assets like Bitcoin lose their appeal, leading to a decrease in their value as rates continue to climb.

Esperanza on Catalysts to Watch: Whales, ETF Boost

In the unfolding market trend, key catalysts could determine the future trajectory of Bitcoin's price.

The first pertains to the actions of Bitcoin whales.

On Sunday, Oct. 20, Whale Alert reported a dormant whale making its first transaction in 13.4 years.

When old BTC whales re-emerge, it is typically considered a bearish sign that could precede a sell-off in the market.

The logic follows that old holders are resurfacing to cash out on their holdings. Many market participants believe that if more Bitcoin whale addresses continue to emerge, it could lead to further downside for Bitcoin.

Another factor to watch is the performance of US spot Bitcoin Exchange-Traded Funds (ETFs).

Bitcoin ETFs recorded an impressive $20.66 billion in net inflows between Oct. 1 and 17. This recent surge in inflows indicates that Bitcoin continues to be a hot topic among institutional players.

If this trend continues, we could see BTC price attempt to reclaim its previous highs or even move higher.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- Coinbase Global (COIN) Stock Is About to Form the Dreaded Death Cross Pattern

- Mar 31, 2025 at 10:35 pm

- While Coinbase Global (COIN) may have started the year with great promise, the cryptocurrency exchange operator couldn't overcome the macroeconomic conditions sinking sentiment for tech and digital stock assets.

-

-

-

-