|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin (BTC) price closes its best weekly performance since the second week of January

Apr 15, 2025 at 01:01 am

The 2-year and 10-year US Treasury yields dipped on Monday, April 14, after Bitcoin (BTC) closed its best weekly performance since the second week of January.

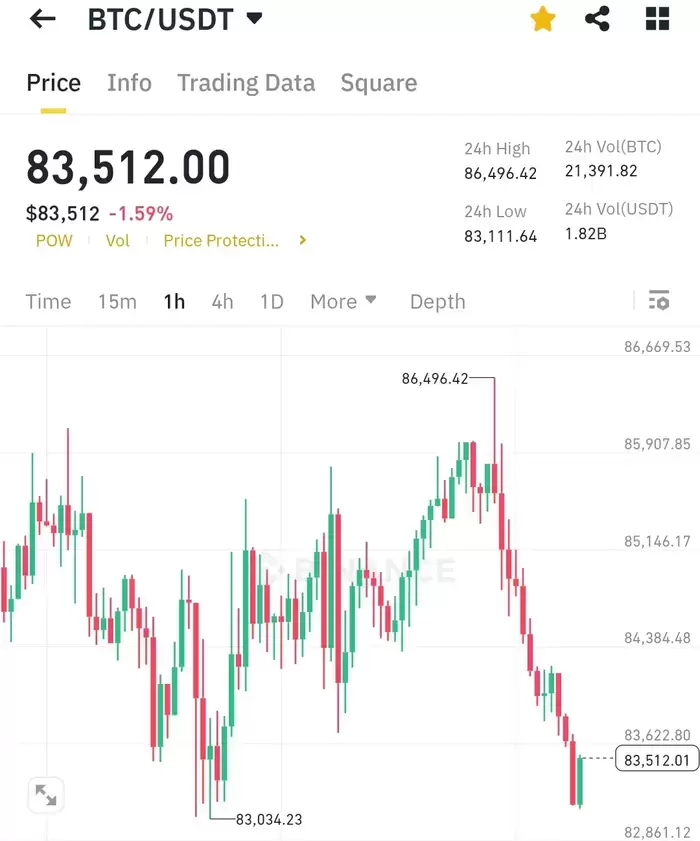

The 2-year and 10-year US Treasury yields dipped on Monday, April 14, after Bitcoin (BTC) closed its best weekly performance since the second week of January. Bitcoins price gained 6.79% over the past week, but are enough factors aligned to support continued price upside?

The 10-year treasury yield saw an 8.2 basis point decline to 4.40% during the New York trading session, while the 2-year treasury saw an 8 basis point slip to 3.88%. The drop in yields comes after possible tariff exemptions on smartphones, computers, and semiconductors were introduced to give US companies time to move production domestically. However, US President Donald Trump stated that these exemptions were temporary in nature.

US 10-year treasury bond yields chart. Source: TradingView

The tariff exemptions, which were announced on April 12, came at the end of a bullish week for Bitcoin. After forming new yearly lows at $74,500, BTC price rebounded 15% to $86,100 between April 9-13.

Easing US treasury yields could be a double-edged sword for Bitcoin. Lower yields decrease the appeal for fixed-income assets, improving capital injection into risk-on assets like BTC. Still, the uncertainty of “temporary exemptions” and the ongoing trade war with China keeps Bitcoin susceptible to further price volatility.

As an “inflation hedge,” Bitcoin continues to draw mixed opinions, but recent uncertainty over trade policies increases inflation fears, improving BTC’s store of value narrative. Yet, recent US inflation data suggested a cooling trend, as the Consumer Price Index (CPI) for March 2025 indicated a year-over-year inflation rate of 2.4%, down from 2.8% in February, marking the lowest since February 2023, which could be indirectly bearish for Bitcoin in the short term.

Bitcoin price hurdles present at $88K to $90K

Trading resource Material Indicators noted that Bitcoin retained a bullish position above its 50-weekly moving average and quarterly open at $82,500. A strong weekly close implied a higher possibility that Bitcoin is less likely to re-visit its previous weekly lows anytime soon. The analysis noted,

“Above 50-W MA, Q1 Open at 82.5k and no lower highs yet. A strong green candle week closed above 80k. Less likely to revisit previous weekly lows.”

Likewise, Alphractal founder Joao Wedson suggested that Bitcoin may be nearing a bullish reversal, as the Perpetual-Spot Gap on Binance—a key indicator tracking the price difference between Bitcoin’s perpetual futures and spot markets, has been narrowing since late 2024.

Bitcoin Perpetual-spot price gap chart. Source: X.com

In a recent X post, Wedson highlighted that this shrinking gap, currently negative, signals fading bearish sentiment, with historical trends from 2020–2021 and 2024 showing that a positive gap often leads to a Bitcoin rally. Wedson noted that a flip to a positive gap could indicate returning buyer momentum. However, he cautioned that such negative gaps persisted during the 2022–2023 bear market.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- Ripple Eyes a Landmark SEC Settlement Paid in XRP as CEO Brad Garlinghouse Boldly Forecasts Bitcoin Hitting $200,000

- Apr 16, 2025 at 01:25 pm

- Ripple Chief Executive Brad Garlinghouse said the company’s settlement with the U.S. Securities and Exchange Commission (SEC) could potentially involve payment in XRP. He also offered a bullish outlook on bitcoin’s future price during an April 10 interview with Fox Business.

-

-

-

- Fresh From Convincing GameStop to Buy Bitcoin, Strive Asset Management CEO Matt Cole Now Wants Intuit to Do the Same

- Apr 16, 2025 at 01:20 pm

- input: Fresh from successfully convincing game retailer GameStop to add Bitcoin to its balance sheet, Strive Asset Management CEO Matt Cole has now set his sights on fintech firm Intuit to do the same.

-

-

- Bitcoin (BTC) Faces a Critical Test as Global Markets Remain Volatile and Macroeconomic Tensions Escalate

- Apr 16, 2025 at 01:15 pm

- Bitcoin is facing a critical test as global markets remain volatile and macroeconomic tensions escalate. After weeks of price swings and uncertainty, BTC is trading above the $85,000 level — a psychological and technical threshold that bulls have managed to defend.

-

- Bitcoin (BTC) has been moving between $80,00 and $85,00 for the fourth day as the uncertain market for the U.S.-China trade dispute continues.

- Apr 16, 2025 at 01:10 pm

- In the meantime, most of the world's transactions are from de facto kimchi coins from Korean exchanges. All of the top coins in the upbit growth rate over the past week were also taken up by coins with a high share of Korean transactions.