|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin (BTC) Fights to Reclaim Key Resistance Levels as Macro Uncertainty and Trade War Fears Continue to Impact Both Crypto and Equities

Mar 20, 2025 at 01:00 am

Bitcoin is fighting to reclaim key resistance levels as macroeconomic uncertainty and trade war fears continue to impact both crypto and equities in the U.S.

Bitcoin (BTC) is battling to reclaim key resistance levels as macroeconomic uncertainty and trade war fears continue to impact both crypto and equities in the U.S.

The leading cryptocurrency has lost over 29% of its value since January, and the downtrend shows no clear signs of reversal yet. As Bitcoin struggles below key levels, investors are questioning whether the bull cycle is over or if the market is setting up for a major comeback.

Despite the negative sentiment, on-chain metrics suggest that demand for BTC and ETH remains strong. CryptoQuant data reveals that the current spread between the Exchange Inflow of all stablecoins on the Ethereum network and the Inflow of BTC + ETH (selling pressure) exceeds all previous peaks in coin demand.

Historically, such trends have marked key accumulation zones before price recoveries. Notably, the highest demand for BTC and ETH was recorded near Bitcoin’s all-time high (ATH) at $101K.

While uncertainty persists, this on-chain signal suggests that accumulation may be brewing, giving Bitcoin the potential to stabilize and reclaim higher price levels. The next few days will be critical in determining whether bulls can manage to regain control or if further declines are on the horizon.

Bitcoin Enters Bear Market Territory

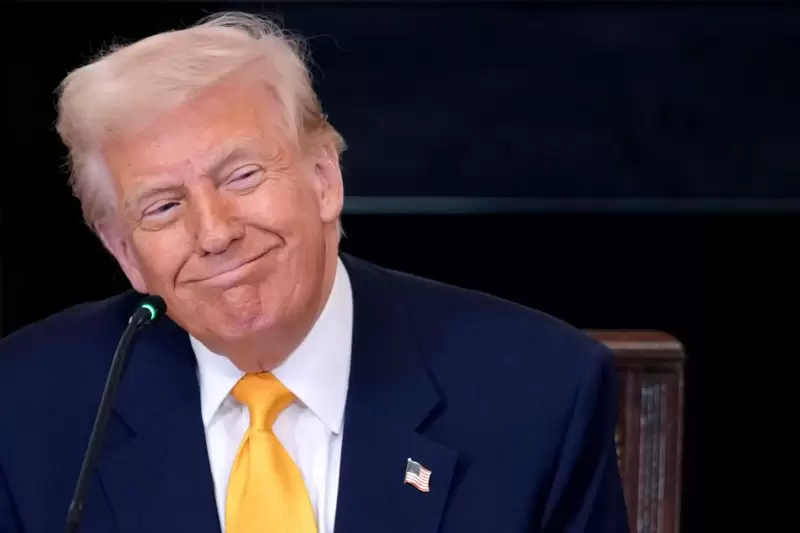

Bitcoin has officially entered bear market territory, with many analysts forecasting a deeper correction as fear spreads across global financial markets. Erratic policies by U.S. President Trump, including tariffs and foreign trade decisions, have contributed to economic instability, with rising speculation about a potential recession.

These factors have shaken both the crypto and equity markets, leading to a continued decline in Bitcoin’s price. However, not all analysts believe that the bull cycle has come to an end.

Some maintain that despite the correction, strong demand remains for BTC and ETH. Top analyst Axel Adler shared insights on X, highlighting that the current spread between the Exchange Inflow of all stablecoins on the Ethereum network and the Inflow of BTC + ETH (selling pressure) outpaces all previous peaks in coin demand.

As depicted in the chart above, Adler notes that similar trends have historically marked key accumulation zones, setting the stage for major price recoveries. The apex demand for BTC + ETH was observed during the period when Bitcoin approached its all-time high (ATH) of $101K.

The chart also shows the metric’s peaks, denoted by green circles, which coincide with active periods of accumulation in the market. At present, the spread is elevated above all prior peaks and stands at a single standard deviation from the annual average levels.

Since September 2023, Bitcoin has displayed sustained demand growth, which is evident in the steeper slope, at an angle of roughly 45 degrees, of the range curve for this metric. If this pattern persists, it may indicate that Bitcoin is nearing the endpoint of its correction, setting the stage for a potential recovery in the upcoming months.

The Importance Of Reclaiming Key Levels

Bitcoin is currently trading at $83,500 after losing the 200-day moving average (MA) around $84,300. The ongoing battle between bulls and bears remains fierce, with BTC struggling to reclaim a key resistance level.

For a recovery scenario to take shape, Bitcoin must manage to push above the $86,000 level with strength, ultimately confirming a shift in momentum. This move would open the door for a potential retest of the $90K mark, which remains a critical psychological and technical resistance.

However, failing to reclaim $86K in the coming sessions could spell trouble for bulls. If BTC continues to struggle below this level, a drop below the $80K support zone becomes increasingly likely. A break below this level could trigger a deeper correction, potentially leading BTC into the $75K-$78K demand zone.

For now, Bitcoin remains in a consolidation phase below key moving averages, and the lack of bullish momentum raises concerns about further downside risk. Traders and investors will closely monitor whether BTC can regain lost ground or if continued selling pressure will push prices toward lower levels. The next few days will be crucial in determining Bitcoin’s short-term trajectory.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Trump Token Unlocks Are When a Group of People—Usually Project Team Members, Early Investors or Advisors—Receive Their Allocated Tokens

- Apr 22, 2025 at 09:35 am

- Token unlocks are when a group of people—usually project team members, early investors or advisors—receive their allocated tokens for free or at a lower price

-

- Meme cryptocurrency Dogecoin is currently trading at an important support level against Bitcoin

- Apr 22, 2025 at 09:35 am

- This significant observation comes from crypto analyst MasterAnanda, whose latest technical analysis on the TradingView platform highlights the potential for another major Dogecoin rally

-

- Dogecoin (DOGE) Price Broke Out of Two Technical Patterns, Setting the Stage for a Bullish Run

- Apr 22, 2025 at 09:30 am

- Dogecoin price signaled a bullish reversal after breaking out of two critical technical patterns this week. The market breakout created fresh expectations as analysts predicted DOGE price could reach between $0.20 and $0.29.

-

-

-

-

- Debunking the $5800 XRP Claim: Samson Mow Explains Why It's Unrealistic

- Apr 22, 2025 at 09:20 am

- Though strong price projections are not unusual in the crypto space, occasionally, the speculation reaches levels worthy of examination. Recently, JAN3 CEO Samson Mow, an outspoken Bitcoin maximalist, reacted to assertions implying XRP would one day be worth $5,800, equivalent to or perhaps surpassing Bitcoin in value.

-

-