|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin vs. Altcoins: A Holiday Season Market Dynamics Analysis

Dec 26, 2024 at 12:00 am

As the holiday season progresses, the cryptocurrency market has been buzzing with activity, showcasing a battle for dominance between Bitcoin [BTC] and altcoins.

The holiday season is upon us, and the cryptocurrency market is abuzz with activity. In this battle for dominance, Bitcoin [BTC] and altcoins are vying for traders’ attention.

Throughout history, this period has presented unique market dynamics, with Bitcoin often perceived as the stable choice and altcoins catering to risk-tolerant traders seeking high returns.

An analysis of these two segments offers valuable insights into which could emerge as the holiday season winner.

Bitcoin: A steady performer amidst market flux

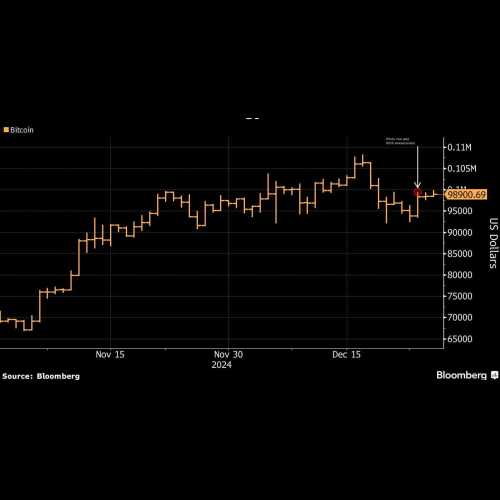

During this holiday period, Bitcoin has shown resilience, maintaining its price at $97,955 with a daily gain of 4.18%.

The market dominance chart highlights Bitcoin’s stronghold at 56.60%, indicating a clear preference among investors for the leading cryptocurrency.

This dominance showcases Bitcoin’s ability to withstand market turbulence while delivering stable returns.

The market heatmap further emphasizes Bitcoin’s consistent performance, with trading volume exceeding $43.87 billion in the last 24 hours.

Such robust activity reflects sustained institutional interest and retail confidence in Bitcoin’s role as a “safe-haven” asset during volatile times.

Despite competition from altcoins, Bitcoin’s steady upward trend cements its position as a reliable asset, especially for long-term holders seeking lower risk during a seasonally volatile period.

Altcoin season index: A shift in momentum

The Altcoin Season Index provides a comprehensive view of the broader market dynamics. At press time, the index was at 49, signaling a neutral stance between Bitcoin and altcoins.

This follows a sharp decline from its earlier high of 75, which marked a dominant altcoin rally. The drop suggests a shift in market sentiment, with Bitcoin regaining favor.

A closer look at the index reveals mixed performances within the altcoin sector.

Notable assets such as Ethereum [ETH] (up 2.5%) and Solana [SOL] (up 4.14%) have posted gains, yet the broader altcoin market remains fragmented.

The oversold/overbought chart offers additional insight, showing a divergence in performance.

XRP and Aave [AAVE] are in overbought territory, implying potential corrections, while oversold assets highlight buying opportunities for speculative traders.

Overbought vs. oversold: A tale of divergence

An analysis of the oversold/overbought chart by AMBCrypto reveals the stark contrast between Bitcoin and altcoins.

While Bitcoin remained within a neutral zone, indicating balanced sentiment, many altcoins were scattered across overbought and oversold territories.

Assets like Zcash [ZEC] and XRP appeared overbought, suggesting limited upside and potential profit-taking.

On the other hand, oversold altcoins presented opportunities for investors looking for undervalued assets to capitalize on during the holiday period.

This divergence highlights the speculative nature of altcoins, which often see amplified volatility compared to Bitcoin.

While this creates opportunities for short-term gains, it also increases the risks of investing in altcoins during uncertain market conditions.

Bitcoin’s vs. Altcoin: Stability vs. volatility

The market heatmap underscores Bitcoin’s dominance in trading activity and market capitalization, reflecting its role as a stabilizing force.

While delivering higher percentage gains in some cases, altcoins remained prone to sharp price swings due to lower liquidity and speculative interest.

Bitcoin’s consistent trading volume and dominance indicated a more stable sentiment than the fragmented and speculative nature of altcoins.

The neutral stance on the Altcoin Season Index suggests that while altcoins have seen individual successes, the broader market remains tilted toward Bitcoin as the preferred asset.

The holiday season winner

Based on the analysis, Bitcoin appears to have the edge during this holiday season.

Its stability, rising dominance, and strong trading volumes make it the asset of choice for long-term investors and risk-averse traders.

However, the altcoin market offers pockets of opportunity for those willing to navigate its volatility, with assets in oversold territory presenting potential entry points.

The ultimate winner depends on investor objectives. For those prioritizing stability and sustained growth, Bitcoin remains the champion.

Selective altcoins could deliver surprises for those seeking higher risks and potentially higher rewards. As the holiday season progresses, keeping a close eye on these metrics will clarify the evolving dynamics of Bitcoin vs. altcoins.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

- Moon Active Coin Master Links Today: Get 110 Spins and 7 Million Coins (December 26, 2024)

- Dec 26, 2024 at 02:35 pm

- Moon Active released three Coin Master links on December 26, 2024. Two links were posted on the game's official Facebook page, one granting 50 spins and the other providing 10 spins and seven million coins. Another link was posted on the title's Threads account, offering 50 spins upon redemption.

-

-

-

-

-

- How $USUAL Can reach $10 dollars per Unit

- Dec 26, 2024 at 02:25 pm