|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Aussie Crypto Trader Reveals His Top Altcoin Picks as Bitcoin Dominance Rises

Oct 17, 2024 at 12:17 pm

In a catchy title called “$100k Bitcoin in 10 Weeks“, Aussie crypto trader Miles Deutscher revealed his top picks across four major sectors in crypto, while giving some insight into BTC’s potential value and some strategies for positioning to get ahead of the market.

Aussie crypto trader Miles Deutscher has revealed his top picks across four major sectors in crypto, while giving some insight into BTC’s potential value and some strategies for getting ahead of the market.

The Aussie analyst has previously doubled down on the imminent rise of the altcoin market, stating that medium to large-cap tokens could be on the verge of a breakout or a breakdown.

In a recent tweet, the analyst revealed which tokens he thinks will lead the next altcoin season.

Here's a snippet from his picks:

Aside from memes, these are the 4 verticals that I think have the most upside this bull run.

Here are some of my top picks from each sector:

Gaming: $SUPER, $BEAM, $PRIME

AI: $TAO, $NEAR, $CARV

DePIN: $AR, $RNDR, $WMT, $ATHR

WA: $CPOOL, $OM, $ONDO

SUPER tops Deutscher’s list — the native utility token for the SuperVerse ecosystem, which focuses on NFTs and blockchain gaming.

Formerly known as SuperFarm, SUPER is an ERC-20 token on the Ethereum blockchain. It has several uses, including governance — allowing holders to vote in the SuperVerse DAO — paying platform fees, and staking for rewards.

The token has gained significant attention due to its role in play-to-earn (P2E) models and NFT integration. Its price has surged over 50% on the monthly chart, currently priced at US$1.31 (AU$1.96).

TAO is highlighted for its connection to AI, a sector with transformative potential across various industries. The token has gained visibility, even receiving a boost from Elon Musk. Deutscher sees TAO as a solid investment in AI infrastructure, offering buying opportunities during minor market pullbacks, making it a strong choice for those interested in the AI narrative.

On the DePIN sector (decentralised physical infrastructure networks), the analyst has two popular coins in his crosshair: Render Network (RNDR) and Arweave (AR).

Arweave is a decentralised storage network designed to offer permanent, low-cost data storage. It introduces the concept of the “Permaweb”, a community-owned, permanent web where data is stored and always accessible.

Arweave’s simplicity and innovative features have pushed its token to new heights, reaching a market capitalisation of over US$1.2B (AU$1.79B), according to CoinMarketCap data.

Render Network, on the other hand, is the leading DePIN platform, with a fully diluted value (FDV) of nearly US$3B (AU$4.49B).

The project gained notoriety for its ability to share and monetise idle GPU power, facilitating decentralised rendering through a global network of GPUs that can help with tasks such as 3D rendering and AI computations.

Render’s appeal is that it offers these services at a fraction of traditional costs, using the RNDR token as the currency for each transaction.

Is Bitcoin on the verge of a breakout?

Deutscher mentions the importance of monitoring Bitcoin’s dominance, which has risen since April 2023.

The analyst explains that increasing dominance typically leads to the early stages of a new cycle, with Bitcoin leading the way before altcoins catch up. He also emphasised that the rise in dominance, coupled with BTC’s price increase, is a bullish sign for altcoins in the longer term.

We can use the path of altseason to better understand this— as BTC’s price performs well, liquidity (investors) tends to flow into altcoins.

In terms of strategy, Deutscher suggests a macro risk-on and micro-neutral approach, stating that he prefers exposure to high-quality altcoins, such as AI and GameFi, without using leverage in current choppy market conditions.

Instead, the analyst wants to focus on accumulating assets during market dips and leverage shakeouts, when over-leveraged traders are liquidated, presenting opportunities for those with a more cautious approach.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

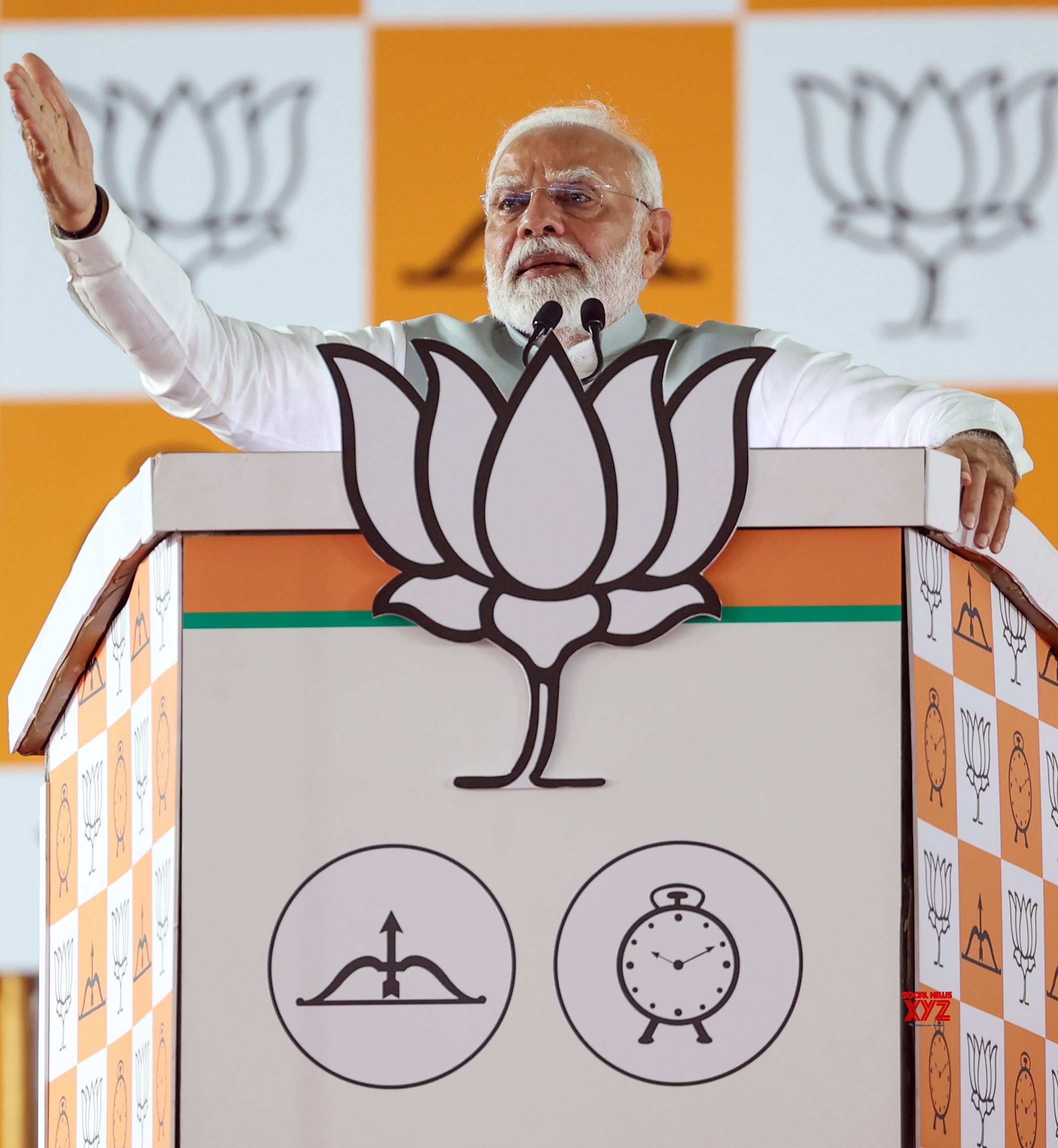

- PM Modi to visit Bihar's Jamui district to inaugurate multiple development projects worth over Rs 6,640 crore

- Nov 15, 2024 at 12:15 pm

- This step is aimed at uplifting tribal communities and improving infrastructure in rural and remote areas of the region on the commencement of the 150th birth anniversary year celebration of Dharti Aaba, Birsa Munda.

-

-

-

-

- Shiba Inu: Meme Coin or Financial Revolution?

- Nov 15, 2024 at 12:15 pm

- Shiba Inu, often referred to as “Shiba,” has made a notable impact in the world of cryptocurrency since its inception. Known for its vibrant community and meme-based origins, Shiba Inu has become a household name among digital currencies. But where exactly is Shiba Inu headed in the market?