Communtity feeds

-

- Twitter source

- Sjuul | AltCryptoGems Apr 01, 2025 at 06:00 pm

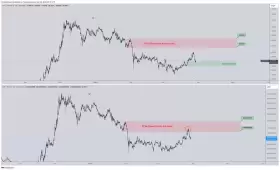

$CRV remains one of the best charts out there. I've been bullish about this for a while, as you can see. Now we also got the perfect retest and pump. I'm still bullish on this. The next stop is that resistance and the real stress test. Team

-

- Twitter source

- fatihcrypto Apr 01, 2025 at 04:38 pm

-

- Twitter source

- CrediBULL Crypto Apr 01, 2025 at 10:26 am

-

- Twitter source

- CrediBULL Crypto Mar 30, 2025 at 04:41 am

-

-

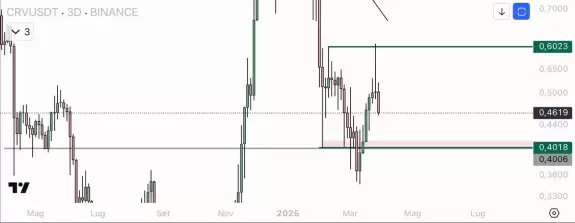

- $CRV we made a 50% gain in a few days riding it all

now i will only re-enter if i get a retest in a huonq demand zone ... otherwise happy to have squeezed it

-

- Twitter source

- {{val.author }} {{val.createtime }}