-

Bitcoin

Bitcoin $84,337.3754

0.36% -

Ethereum

Ethereum $1,991.9290

1.46% -

Tether USDt

Tether USDt $0.9998

0.02% -

XRP

XRP $2.3958

0.66% -

BNB

BNB $628.1015

-1.08% -

Solana

Solana $131.3838

3.88% -

USDC

USDC $1.0001

0.00% -

Cardano

Cardano $0.7135

1.41% -

Dogecoin

Dogecoin $0.1690

1.22% -

TRON

TRON $0.2339

-0.25% -

Chainlink

Chainlink $14.2653

1.80% -

UNUS SED LEO

UNUS SED LEO $9.7370

-0.26% -

Toncoin

Toncoin $3.6211

-0.03% -

Stellar

Stellar $0.2768

-0.12% -

Avalanche

Avalanche $19.5586

5.60% -

Hedera

Hedera $0.1852

0.34% -

Shiba Inu

Shiba Inu $0.0...01270

0.55% -

Sui

Sui $2.2964

2.24% -

Polkadot

Polkadot $4.4667

0.68% -

Litecoin

Litecoin $91.4830

-1.56% -

Pi

Pi $1.0058

12.86% -

Bitcoin Cash

Bitcoin Cash $325.0900

-2.75% -

MANTRA

MANTRA $6.3458

-1.57% -

Bitget Token

Bitget Token $4.7514

3.81% -

Hyperliquid

Hyperliquid $16.2859

14.34% -

Ethena USDe

Ethena USDe $0.9993

-0.01% -

Dai

Dai $1.0001

0.01% -

Uniswap

Uniswap $6.8302

0.20% -

Monero

Monero $214.7710

2.63% -

Aptos

Aptos $5.7799

6.23%

How to play perpetual contract with AscendEX

Navigating perpetual contracts on AscendEX entails understanding the concept, carefully managing leverage, and adhering to sound risk management principles to maximize trading outcomes.

Nov 28, 2024 at 11:06 am

Comprehensive Guide to Navigating Perpetual Contracts on AscendEX

Introduction

Perpetual contracts, also known as perpetual futures, have emerged as innovative financial instruments in the realm of cryptocurrency trading. AscendEX, a leading digital asset exchange, offers a sophisticated platform for traders to engage in perpetual contract trading. This guide provides a comprehensive overview of how to effectively navigate perpetual contracts on AscendEX.

Understanding Perpetual Contracts

- Definition: Perpetual contracts are derivative instruments that simulate the price movements of an underlying asset, such as Bitcoin, without having an expiration date. They allow traders to take positions and speculate on future price fluctuations.

- Leverage: Perpetual contracts provide leverage, enabling traders to magnify their potential gains or losses by using borrowed funds. However, it's crucial to manage leverage carefully, as it can amplify both profits and risks.

- Funding Rate: Perpetual contracts employ a funding rate mechanism to balance long and short positions. This rate is adjusted periodically and is paid by one party to the other, depending on the market's positioning.

Getting Started with AscendEX

- Account Creation: To participate in perpetual contract trading on AscendEX, you must first create an account and complete the KYC verification process.

- Funding Your Account: Deposit funds into your AscendEX account using supported methods like credit/debit cards, wire transfers, or cryptocurrencies.

- Trading Interface: Navigate to the "Futures" tab on the AscendEX platform to access the perpetual contract trading interface. Choose the desired contract (e.g., BTC/USDT) and select your preferred leverage level.

Trading Perpetual Contracts

- Placing Orders: Use the order form to specify the contract amount, price, and order type (market, limit, or stop-limit). Market orders execute immediately at the current market price, while limit orders are triggered when the price reaches the specified level.

- Monitoring Positions: Track your open positions and their performance in the "Positions" section. Adjust your position size or strategy as needed.

- Managing Risk: Implement appropriate risk management strategies, such as stop-loss orders or trailing stop orders, to mitigate potential losses.

Funding and Settlement

- Funding: Calculate and pay the funding rate when it becomes due. AscendEX automatically handles funding settlements, which can be either positive or negative.

- Settlement: Perpetual contracts do not expire, but they can be closed at any time by placing an opposite position. The resulting gain or loss is settled in the quoted currency (e.g., USDT for BTC/USDT contracts).

Tips for Success

- Research and Education: Understand the risks and mechanics of perpetual contract trading before engaging in real trading.

- Practice Risk Management: Leverage can magnify both profits and losses, so manage your risk exposure wisely.

- Monitor the Market: Stay up-to-date on cryptocurrency news and market dynamics that can impact perpetual contract prices.

- Use Stop-Loss Orders: Protect your capital by setting stop-loss orders to limit potential losses.

- Use Leverage Prudently: While leverage can enhance your profits, it also increases your risk. Use it cautiously and according to your risk tolerance.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

- According to CoinGecko, 44% of surveyed individuals hold a bullish stance on AI-related cryptocurrency prices.

- 2025-03-22 19:50:12

- Binance Coin (BNB) Price Prediction: Will the Upward Trend Continue?

- 2025-03-22 19:50:12

- Mutuum Finance (MUTM) Is Gaining a Lot of Interest as the Crypto Market Turns from Meme Corner Excitement to Projects Actually Providing Concrete Utility

- 2025-03-22 19:45:12

- Bitcoin (BTC) May Have Already Reached Its Peak This Bull Cycle, As Technical Indicators Suggest Loss of Momentum

- 2025-03-22 19:45:12

- Memecoins Emerge as Trending Cryptocurrencies

- 2025-03-22 19:40:12

- BlockDAG (BDAG) Captures Attention as a Top Crypto Project for 2025

- 2025-03-22 19:40:12

Related knowledge

how to find bitcoin contract address

Mar 22,2025 at 05:07pm

How to Find a Bitcoin Contract Address: A Deep DiveFinding a Bitcoin contract address requires understanding that Bitcoin itself doesn't inherently support smart contracts like Ethereum. The concept of a "contract address" is fundamentally tied to blockchain platforms with smart contract functionality. Therefore, searching for a Bitcoin contract address...

bitcoin smart contracts example

Mar 22,2025 at 05:35am

Bitcoin Smart Contracts: Example Use Cases and Technical LimitationsBitcoin, initially designed as a peer-to-peer electronic cash system, has limitations in supporting complex smart contracts like those found on Ethereum. While Bitcoin doesn't natively support Turing-complete smart contracts, several methods are being explored to enhance its functionali...

how to trade bitcoin futures on coinbase

Mar 22,2025 at 01:49am

How to Trade Bitcoin Futures on CoinbaseCoinbase, a prominent cryptocurrency exchange, doesn't currently offer direct Bitcoin futures trading. This is a key distinction to understand. While Coinbase provides a platform for spot trading Bitcoin (buying and selling Bitcoin at the current market price), futures contracts are not part of their current produ...

how to trade futures on binance mobile app

Mar 20,2025 at 02:35pm

Key Points:Binance's mobile app provides access to a range of cryptocurrency futures contracts.Trading futures involves significant risk due to leverage and price volatility.Understanding margin, leverage, and liquidation is crucial before trading.The app offers various order types to manage risk and execute trades effectively.Security practices like st...

how to trade futures on binance for beginners

Mar 20,2025 at 05:14pm

Key Points:Understanding Binance Futures: A brief overview of what Binance Futures is and its risks.Account Setup and Security: Steps to create a Binance Futures account and secure it.Understanding Leverage and Margin: Explaining leverage, margin calls, and liquidation.Placing Your First Trade: A step-by-step guide to executing a simple long or short tr...

how to trade binance futures in europe

Mar 20,2025 at 03:35pm

Key Points:Binance Futures is available in most of Europe, but regulations vary by country.Trading involves significant risk and requires understanding of leverage and margin.Account verification and KYC procedures are mandatory.Different order types offer varying levels of control and risk management.Security measures are crucial to protect your assets...

how to find bitcoin contract address

Mar 22,2025 at 05:07pm

How to Find a Bitcoin Contract Address: A Deep DiveFinding a Bitcoin contract address requires understanding that Bitcoin itself doesn't inherently support smart contracts like Ethereum. The concept of a "contract address" is fundamentally tied to blockchain platforms with smart contract functionality. Therefore, searching for a Bitcoin contract address...

bitcoin smart contracts example

Mar 22,2025 at 05:35am

Bitcoin Smart Contracts: Example Use Cases and Technical LimitationsBitcoin, initially designed as a peer-to-peer electronic cash system, has limitations in supporting complex smart contracts like those found on Ethereum. While Bitcoin doesn't natively support Turing-complete smart contracts, several methods are being explored to enhance its functionali...

how to trade bitcoin futures on coinbase

Mar 22,2025 at 01:49am

How to Trade Bitcoin Futures on CoinbaseCoinbase, a prominent cryptocurrency exchange, doesn't currently offer direct Bitcoin futures trading. This is a key distinction to understand. While Coinbase provides a platform for spot trading Bitcoin (buying and selling Bitcoin at the current market price), futures contracts are not part of their current produ...

how to trade futures on binance mobile app

Mar 20,2025 at 02:35pm

Key Points:Binance's mobile app provides access to a range of cryptocurrency futures contracts.Trading futures involves significant risk due to leverage and price volatility.Understanding margin, leverage, and liquidation is crucial before trading.The app offers various order types to manage risk and execute trades effectively.Security practices like st...

how to trade futures on binance for beginners

Mar 20,2025 at 05:14pm

Key Points:Understanding Binance Futures: A brief overview of what Binance Futures is and its risks.Account Setup and Security: Steps to create a Binance Futures account and secure it.Understanding Leverage and Margin: Explaining leverage, margin calls, and liquidation.Placing Your First Trade: A step-by-step guide to executing a simple long or short tr...

how to trade binance futures in europe

Mar 20,2025 at 03:35pm

Key Points:Binance Futures is available in most of Europe, but regulations vary by country.Trading involves significant risk and requires understanding of leverage and margin.Account verification and KYC procedures are mandatory.Different order types offer varying levels of control and risk management.Security measures are crucial to protect your assets...

See all articles

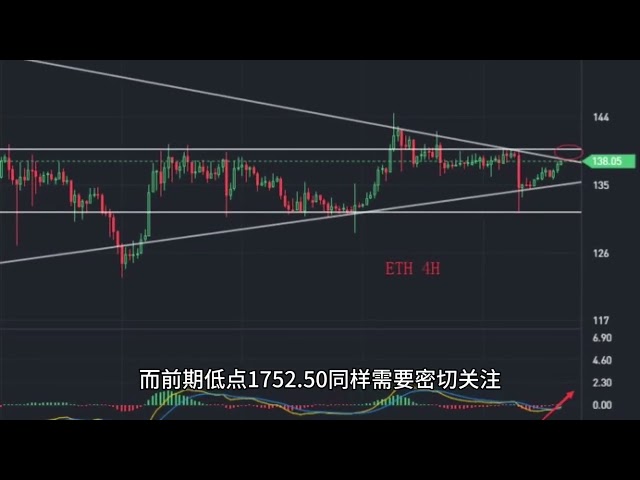

![[Bitcoin David] Bitcoin gun is like a dragon and is optimistic about the future trend: wait and see the contract on Saturday and Sunday, and watch the performance! ! ! [Bitcoin David] Bitcoin gun is like a dragon and is optimistic about the future trend: wait and see the contract on Saturday and Sunday, and watch the performance! ! !](/uploads/2025/03/22/cryptocurrencies-news/videos/bitcoin-david-bitcoin-gun-dragon-optimistic-future-trend-wait-contract-saturday-sunday-watch-performance/image-1.jpg)