-

Bitcoin

Bitcoin $84,337.3754

0.36% -

Ethereum

Ethereum $1,991.9290

1.46% -

Tether USDt

Tether USDt $0.9998

0.02% -

XRP

XRP $2.3958

0.66% -

BNB

BNB $628.1015

-1.08% -

Solana

Solana $131.3838

3.88% -

USDC

USDC $1.0001

0.00% -

Cardano

Cardano $0.7135

1.41% -

Dogecoin

Dogecoin $0.1690

1.22% -

TRON

TRON $0.2339

-0.25% -

Chainlink

Chainlink $14.2653

1.80% -

UNUS SED LEO

UNUS SED LEO $9.7370

-0.26% -

Toncoin

Toncoin $3.6211

-0.03% -

Stellar

Stellar $0.2768

-0.12% -

Avalanche

Avalanche $19.5586

5.60% -

Hedera

Hedera $0.1852

0.34% -

Shiba Inu

Shiba Inu $0.0...01270

0.55% -

Sui

Sui $2.2964

2.24% -

Polkadot

Polkadot $4.4667

0.68% -

Litecoin

Litecoin $91.4830

-1.56% -

Pi

Pi $1.0058

12.86% -

Bitcoin Cash

Bitcoin Cash $325.0900

-2.75% -

MANTRA

MANTRA $6.3458

-1.57% -

Bitget Token

Bitget Token $4.7514

3.81% -

Hyperliquid

Hyperliquid $16.2859

14.34% -

Ethena USDe

Ethena USDe $0.9993

-0.01% -

Dai

Dai $1.0001

0.01% -

Uniswap

Uniswap $6.8302

0.20% -

Monero

Monero $214.7710

2.63% -

Aptos

Aptos $5.7799

6.23%

How to play Deepcoin exchange contracts

Deepcoin, a cryptocurrency exchange, offers contract trading, a speculative instrument that allows users to predict asset price shifts without ownership, but requires understanding the risks involved and the cryptocurrency market before engaging.

Nov 28, 2024 at 12:33 pm

How to Play Deepcoin Exchange Contracts: A Comprehensive Guide

Deepcoin is a cryptocurrency exchange that offers a wide range of trading options, including contract trading. Contract trading is a form of derivative trading that allows traders to speculate on the future price of an asset without actually owning it. This can be a risky but potentially lucrative way to trade cryptocurrencies.

If you're new to contract trading, it's important to do your research and understand the risks involved. You should also make sure you have a solid understanding of the cryptocurrency market before you start trading.

Once you're ready to start trading contracts on Deepcoin, follow these steps:

- Open an account on Deepcoin

The first step is to open an account on Deepcoin. You can do this by visiting the Deepcoin website and clicking on the "Sign Up" button. You will need to provide your email address, create a password, and agree to the terms of service.

- Fund your account

Once you have opened an account, you will need to fund it with cryptocurrency. You can do this by depositing cryptocurrency from another wallet or by purchasing cryptocurrency directly from Deepcoin.

- Choose a contract

Deepcoin offers a variety of contract types, including perpetual contracts and futures contracts. Perpetual contracts are contracts that do not have an expiration date, while futures contracts expire on a specific date. You can choose the contract type that best suits your trading strategy.

- Place an order

Once you have chosen a contract, you need to place an order. You can do this by clicking on the "Place Order" button and entering the following information:

- Order type: You can choose between a market order or a limit order. A market order will be executed immediately at the current market price, while a limit order will only be executed if the price reaches a specified level.

- Order quantity: This is the number of contracts you want to buy or sell.

- Price: This is the price at which you want to buy or sell the contracts.

- Leverage: This is the amount of leverage you want to use. Leverage allows you to trade with more money than you have in your account, but it also increases your risk of loss.

- Monitor your position

Once you have placed an order, you need to monitor your position. You can do this by clicking on the "Positions" tab in the Deepcoin trading interface. This tab will show you the current status of your open positions.

- Close your position

When you are ready to close your position, you can do so by clicking on the "Close Position" button in the Deepcoin trading interface. This will close your position and sell the contracts back to the market.

Tips for Trading Contracts on Deepcoin

Here are a few tips to help you trade contracts on Deepcoin successfully:

- Do your research: Before you start trading contracts, it's important to do your research and understand the risks involved. You should also make sure you have a solid understanding of the cryptocurrency market.

- Start small: When you first start trading contracts, it's important to start small. This will help you to get a feel for the market and avoid large losses.

- Use stop-loss orders: Stop-loss orders are a type of order that can help you to limit your losses. A stop-loss order will automatically sell your contracts if the price reaches a specified level.

- Take profits: It's important to take profits when you're trading contracts. This will help you to lock in your profits and avoid giving them back to the market.

- Be patient: Contract trading can be a volatile activity. It's important to be patient and not make any rash decisions.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

- Memecoins Emerge as Trending Cryptocurrencies

- 2025-03-22 19:40:12

- BlockDAG (BDAG) Captures Attention as a Top Crypto Project for 2025

- 2025-03-22 19:40:12

- BlockDAG (BDAG) Presale Surpasses $205 Million as the Next Big Crypto to Watch

- 2025-03-22 19:35:12

- Tether CEO Paolo Ardoino Is In Talks With The Big Four Accounting Firms To Finally Conduct A Third-Party Audit

- 2025-03-22 19:35:12

- BNB Price Up 0.75% During Friday's Trading Session to Trade at $634

- 2025-03-22 19:30:12

- Solaxy ($SOLX) Introduces the First-Ever Layer-2 Solution for Solana, Expanding Bitcoin's Capabilities with StratoVM (SVM)

- 2025-03-22 19:30:12

Related knowledge

how to find bitcoin contract address

Mar 22,2025 at 05:07pm

How to Find a Bitcoin Contract Address: A Deep DiveFinding a Bitcoin contract address requires understanding that Bitcoin itself doesn't inherently support smart contracts like Ethereum. The concept of a "contract address" is fundamentally tied to blockchain platforms with smart contract functionality. Therefore, searching for a Bitcoin contract address...

bitcoin smart contracts example

Mar 22,2025 at 05:35am

Bitcoin Smart Contracts: Example Use Cases and Technical LimitationsBitcoin, initially designed as a peer-to-peer electronic cash system, has limitations in supporting complex smart contracts like those found on Ethereum. While Bitcoin doesn't natively support Turing-complete smart contracts, several methods are being explored to enhance its functionali...

how to trade bitcoin futures on coinbase

Mar 22,2025 at 01:49am

How to Trade Bitcoin Futures on CoinbaseCoinbase, a prominent cryptocurrency exchange, doesn't currently offer direct Bitcoin futures trading. This is a key distinction to understand. While Coinbase provides a platform for spot trading Bitcoin (buying and selling Bitcoin at the current market price), futures contracts are not part of their current produ...

how to trade futures on binance mobile app

Mar 20,2025 at 02:35pm

Key Points:Binance's mobile app provides access to a range of cryptocurrency futures contracts.Trading futures involves significant risk due to leverage and price volatility.Understanding margin, leverage, and liquidation is crucial before trading.The app offers various order types to manage risk and execute trades effectively.Security practices like st...

how to trade futures on binance for beginners

Mar 20,2025 at 05:14pm

Key Points:Understanding Binance Futures: A brief overview of what Binance Futures is and its risks.Account Setup and Security: Steps to create a Binance Futures account and secure it.Understanding Leverage and Margin: Explaining leverage, margin calls, and liquidation.Placing Your First Trade: A step-by-step guide to executing a simple long or short tr...

how to trade binance futures in europe

Mar 20,2025 at 03:35pm

Key Points:Binance Futures is available in most of Europe, but regulations vary by country.Trading involves significant risk and requires understanding of leverage and margin.Account verification and KYC procedures are mandatory.Different order types offer varying levels of control and risk management.Security measures are crucial to protect your assets...

how to find bitcoin contract address

Mar 22,2025 at 05:07pm

How to Find a Bitcoin Contract Address: A Deep DiveFinding a Bitcoin contract address requires understanding that Bitcoin itself doesn't inherently support smart contracts like Ethereum. The concept of a "contract address" is fundamentally tied to blockchain platforms with smart contract functionality. Therefore, searching for a Bitcoin contract address...

bitcoin smart contracts example

Mar 22,2025 at 05:35am

Bitcoin Smart Contracts: Example Use Cases and Technical LimitationsBitcoin, initially designed as a peer-to-peer electronic cash system, has limitations in supporting complex smart contracts like those found on Ethereum. While Bitcoin doesn't natively support Turing-complete smart contracts, several methods are being explored to enhance its functionali...

how to trade bitcoin futures on coinbase

Mar 22,2025 at 01:49am

How to Trade Bitcoin Futures on CoinbaseCoinbase, a prominent cryptocurrency exchange, doesn't currently offer direct Bitcoin futures trading. This is a key distinction to understand. While Coinbase provides a platform for spot trading Bitcoin (buying and selling Bitcoin at the current market price), futures contracts are not part of their current produ...

how to trade futures on binance mobile app

Mar 20,2025 at 02:35pm

Key Points:Binance's mobile app provides access to a range of cryptocurrency futures contracts.Trading futures involves significant risk due to leverage and price volatility.Understanding margin, leverage, and liquidation is crucial before trading.The app offers various order types to manage risk and execute trades effectively.Security practices like st...

how to trade futures on binance for beginners

Mar 20,2025 at 05:14pm

Key Points:Understanding Binance Futures: A brief overview of what Binance Futures is and its risks.Account Setup and Security: Steps to create a Binance Futures account and secure it.Understanding Leverage and Margin: Explaining leverage, margin calls, and liquidation.Placing Your First Trade: A step-by-step guide to executing a simple long or short tr...

how to trade binance futures in europe

Mar 20,2025 at 03:35pm

Key Points:Binance Futures is available in most of Europe, but regulations vary by country.Trading involves significant risk and requires understanding of leverage and margin.Account verification and KYC procedures are mandatory.Different order types offer varying levels of control and risk management.Security measures are crucial to protect your assets...

See all articles

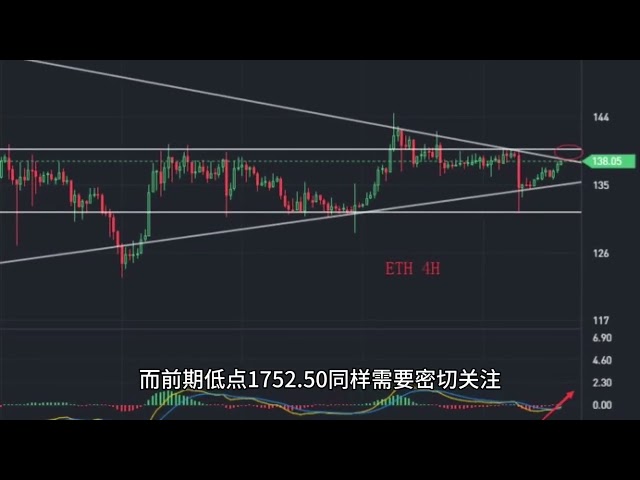

![[Bitcoin David] Bitcoin gun is like a dragon and is optimistic about the future trend: wait and see the contract on Saturday and Sunday, and watch the performance! ! ! [Bitcoin David] Bitcoin gun is like a dragon and is optimistic about the future trend: wait and see the contract on Saturday and Sunday, and watch the performance! ! !](/uploads/2025/03/22/cryptocurrencies-news/videos/bitcoin-david-bitcoin-gun-dragon-optimistic-future-trend-wait-contract-saturday-sunday-watch-performance/image-1.jpg)