|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aave (AAVE) 测试了看涨三角旗趋势线阻力,暗示价格可能突破。从 95 美元强劲反弹至 170 美元之后

Aave encountered a crucial technical juncture, as it faced resistance at a bullish pennant trendline. Following a substantial rally from $95 to $170, traders closely observed this price point, which could determine Aave's next price movement.

Aave 遇到了关键的技术关口,因为它在看涨三角旗趋势线处面临阻力。在从 95 美元大幅上涨至 170 美元之后,交易员密切关注这一价格点,这可能决定 Aave 的下一次价格走势。

On the 12-hour chart, Aave's price action demonstrated strength, positioning it close to key resistance. The bullish pennant structure suggested that a successful breakout above this line would fuel further gains.

在 12 小时图表上,Aave 的价格走势显示出强势,使其接近关键阻力位。看涨三角旗结构表明,成功突破该线将推动进一步上涨。

The price movement reflected a consolidation phase, typically a sign of increased market interest and robust buying activity. With more buying momentum, Aave could comfortably target the $200 level, though a price correction could still occur if the resistance held.

价格走势反映了盘整阶段,通常是市场兴趣增加和购买活动强劲的迹象。随着购买动力的增强,Aave 可以轻松瞄准 200 美元的水平,但如果阻力位保持不变,价格仍可能出现调整。

This critical phase in Aave's trading range encouraged traders to monitor its next step. After this impressive rise, many investors wondered whether it would maintain momentum to cross the resistance and set a new price target above $200.

Aave 交易区间的这一关键阶段鼓励交易者监控下一步走势。在这次令人印象深刻的上涨之后,许多投资者想知道它是否会保持突破阻力的势头,并将新的价格目标设定在 200 美元以上。

As Aave approached price levels of $160, its recent rally attracted attention, and traders anticipated heightened buying pressure in the coming sessions.

随着 Aave 价格接近 160 美元,其最近的上涨引起了人们的关注,交易员预计未来几个交易日的买盘压力将会加大。

Aave's trend had also shown some inconsistencies lately, breaking, reclaiming, and then losing the daily trend on multiple occasions.

Aave 的趋势最近也出现了一些不一致的情况,多次打破、恢复、然后失去每日趋势。

However, these fluctuations were not unexpected, given the asset's previous rally from $95 to $170. Analysts suggested it might stabilize if it maintained the daily trend above critical moving averages.

然而,鉴于该资产此前从 95 美元涨至 170 美元,这些波动并不意外。分析师表示,如果日线趋势保持在关键移动平均线之上,则可能会企稳。

If Aave could secure this trend, it would establish a solid support base, creating conditions for another potential rally. The technical setup also displayed patterns on longer timeframes.

如果 Aave 能够确保这一趋势,它将建立坚实的支撑基础,为另一次潜在反弹创造条件。技术设置还显示了较长时间范围内的模式。

The 2-week chart hinted at an inside bar and pinbar continuation setup, a formation known for its trend-strengthening properties.

两周图暗示了内部柱线和 pinbar 延续形态,这种形态以其趋势强化特性而闻名。

If Aave closed above $166 without a significant upper wick, it could create a bullish engulfing bar, adding momentum to its potential upside.

如果 Aave 收盘于 166 美元上方且没有明显的上影线,则可能会形成看涨吞没柱,从而增加其潜在上涨动力。

This pattern, though early, represented a bullish structure that could validate a price run. A close within the $160-$165 range by the end of the week would further solidify this setup, potentially attracting more buying interest.

这种模式虽然早期,但代表了一种看涨结构,可以验证价格运行。到本周末收于 160-165 美元区间将进一步巩固这一格局,可能会吸引更多购买兴趣。

Furthermore, Aave's fundamental developments could bolster its market position. The recent changes in Aave's tokenomics, which reduced inflationary rewards and emphasized protocol revenue, added stability to its ecosystem.

此外,Aave 的基本面发展可以巩固其市场地位。 Aave 代币经济学最近发生的变化减少了通货膨胀奖励并强调了协议收入,增加了其生态系统的稳定性。

The updated model encouraged staking of Aave's GHO stablecoin, aligning protocol incentives with community engagement.

更新后的模型鼓励对 Aave 的 GHO 稳定币进行质押,使协议激励措施与社区参与保持一致。

As GHO's circulating supply surpassed 170 million, its integration with platforms like Pendle could expand liquidity and boost Aave's presence in the DeFi sector.

随着 GHO 的流通量超过 1.7 亿,它与 Pendle 等平台的整合可以扩大流动性并提升 Aave 在 DeFi 领域的影响力。

This strategic shift in tokenomics aimed to create a more sustainable growth path for Aave. The growing market cap of GHO, with over $170 million in circulation, signaled rising interest and use in the DeFi space.

代币经济的这一战略转变旨在为 Aave 创造一条更可持续的增长道路。 GHO 的市值不断增长,流通量超过 1.7 亿美元,这表明人们对 DeFi 领域的兴趣和使用不断增加。

Aave's plan to prioritize GHO stakers would potentially attract more liquidity and broaden its community. Integrating GHO with Pendle Finance opened the door to collaborative growth in DeFi, presenting new synergies and liquidity opportunities.

Aave 优先考虑 GHO 质押者的计划可能会吸引更多流动性并扩大其社区。 GHO 与 Pendle Finance 的整合打开了 DeFi 合作增长的大门,带来了新的协同效应和流动性机会。

Such partnerships could enhance Aave's value proposition, setting the stage for long-term adoption.

此类合作伙伴关系可以增强 Aave 的价值主张,为长期采用奠定基础。

If Aave successfully crosses its resistance, it would likely see more gains, setting its sights on $200 and beyond. However, if resistance holds, Aave might consolidate within a tighter range.

如果 Aave 成功突破阻力位,它可能会看到更多涨幅,将目标定在 200 美元及以上。然而,如果阻力持续存在,Aave 可能会在更窄的区间内盘整。

This decisive moment for Aave keeps investors and traders alert, as the next few sessions could reveal a clear direction.

对于 Aave 来说,这一决定性时刻让投资者和交易者保持警惕,因为接下来的几个交易日可能会揭示一个明确的方向。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

- 从 310 美元到 962.8k 美元:Sara 的 WIF 赌注如何获得回报

- 2024-11-24 03:35:52

- 没有人愿意袖手旁观,看着别人成功,而自己却落在后面。这正是来自纽约的文学系学生萨拉的感受。

-

- 三人因涉嫌盗窃、出售金币被捕

- 2024-11-24 03:35:52

- 阿肯色州琼斯伯勒(KAIT)——警方称三人涉嫌参与盗窃和出售金币的阴谋,三人被关进监狱。

-

-

- 柴犬对全球经济和文化的巨大影响

- 2024-11-24 02:30:02

- 在不断发展的加密货币世界中,柴犬(SHIB)不仅因其市场创新而且因其对全球生活的影响而掀起波澜。

-

-

-

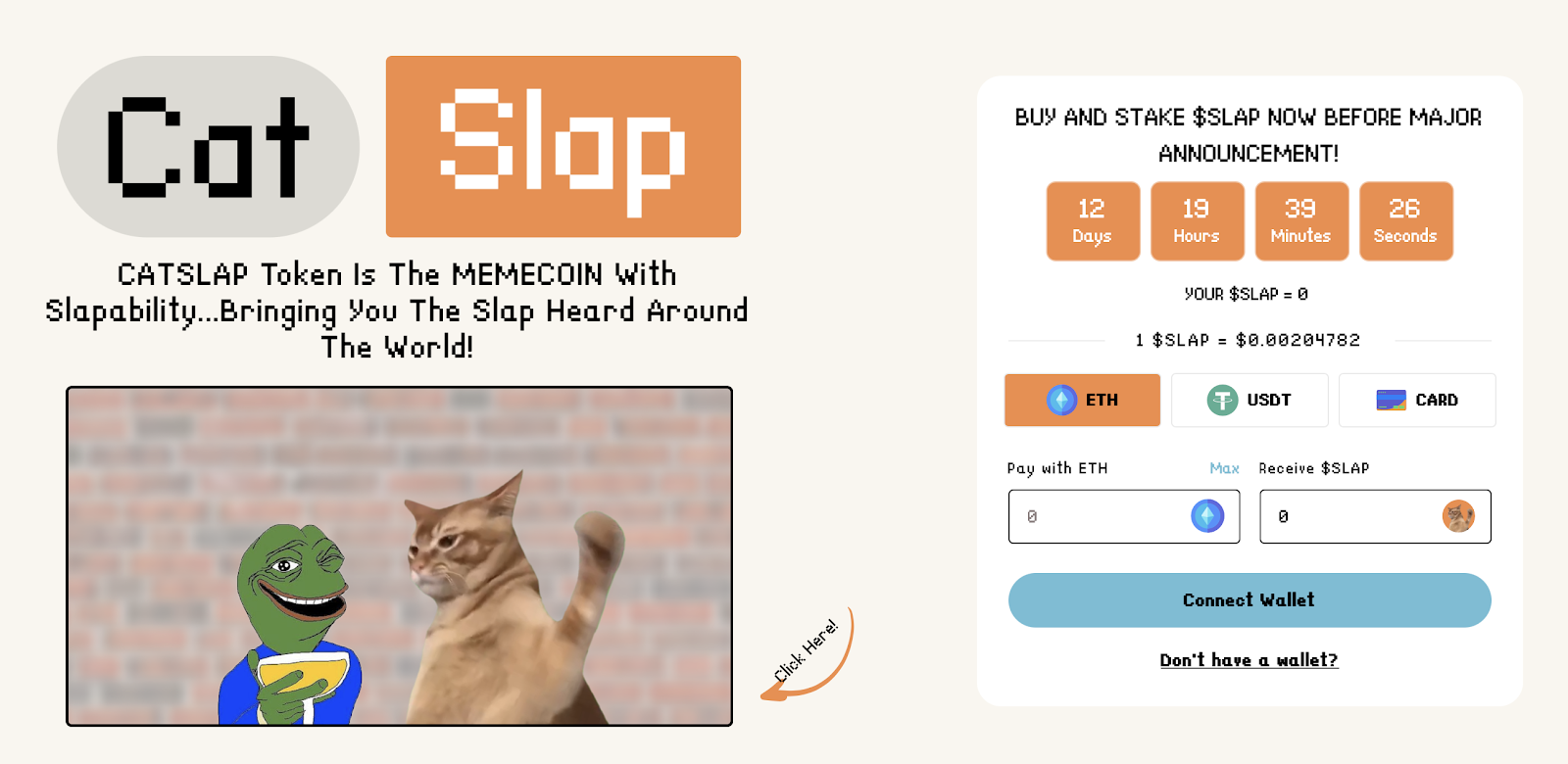

- CatSlap ($SLAP) 是一款震撼加密货币的病毒模因币!

- 2024-11-24 02:30:02

- 了解如何加入行动、获取代币并驾驭下一个大趋势。