|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

川普的世界自由金融(WLF)是一項引起金融界和加密貨幣界關注的重大舉措

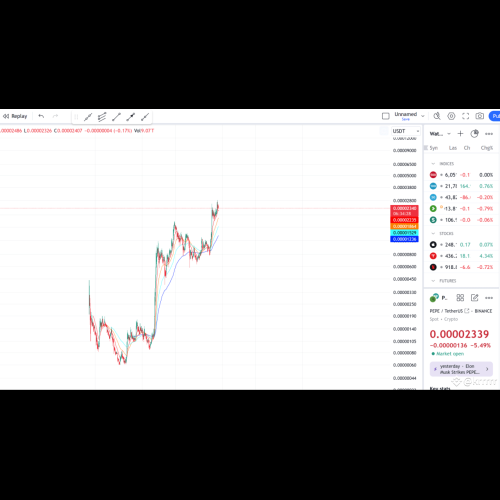

Trump’s World Liberty Financial, a financial services company with ties to former U.S. President Donald Trump, has reportedly acquired $55 million worth of Ethereum (ETH). The move underscores the increasing convergence between traditional finance and the rapidly expanding cryptocurrency market, as more institutions and investors seek to diversify their portfolios with digital assets.

據報道,川普旗下的 World Liberty Financial 是一家與美國前總統川普有聯繫的金融服務公司,已收購了價值 5,500 萬美元的以太坊 (ETH)。此舉凸顯了傳統金融與快速擴張的加密貨幣市場之間的日益融合,因為越來越多的機構和投資者尋求透過數位資產實現投資組合多元化。

The acquisition of $55 million in Ethereum signals a growing recognition of the potential of cryptocurrencies as legitimate assets in institutional investment strategies. Ethereum, the second-largest cryptocurrency by market capitalization after Bitcoin, is seen by many as a more versatile blockchain network due to its support for smart contracts and decentralized applications (dApps). WLF’s decision to hold a significant amount of ETH suggests a long-term belief in the future of blockchain technology, particularly Ethereum’s role in decentralized finance (DeFi), NFTs, and Web3 technologies.

5,500 萬美元收購以太幣標誌著人們越來越認識到加密貨幣作為機構投資策略中合法資產的潛力。以太坊是市值僅次於比特幣的第二大加密貨幣,由於其對智慧合約和去中心化應用程式 (dApp) 的支持,被許多人視為更通用的區塊鏈網路。 WLF 決定持有大量 ETH,顯示了對區塊鏈技術未來的長期信念,特別是以太坊在去中心化金融 (DeFi)、NFT 和 Web3 技術中的作用。

The $55 million purchase marks one of the largest investments made by a traditional financial services firm in Ethereum, drawing attention to the increasing acceptance of digital assets among major institutional investors. The move comes at a time when Ethereum’s price has experienced notable fluctuations, but many analysts remain optimistic about its long-term growth potential, especially with upcoming updates to its network that could enhance scalability and reduce energy consumption.

此次 5,500 萬美元的收購標誌著傳統金融服務公司在以太坊上進行的最大投資之一,引起了人們對主要機構投資者對數位資產日益接受的關注。此舉發生之際,以太坊的價格經歷了顯著波動,但許多分析師仍對其長期成長潛力持樂觀態度,特別是即將推出的網路更新可能會增強可擴展性並降低能耗。

Trump’s World Liberty Financial, which has long been associated with conservative financial strategies and a high-profile political figure, is venturing into new territory by embracing cryptocurrencies. The firm’s CEO has expressed confidence that the acquisition of Ethereum will bolster its portfolio and align with its long-term vision of growth in a rapidly evolving digital landscape.

川普的世界自由金融公司長期以來一直與保守的金融策略和高調的政治人物聯繫在一起,現在正在透過擁抱加密貨幣來冒險進入新領域。該公司執行長表示相信,收購以太坊將增強其投資組合,並符合其在快速發展的數位環境中實現成長的長期願景。

This move marks a significant shift in the company’s approach, as it traditionally focused on more conventional investment vehicles. However, as cryptocurrencies continue to grow in prominence, it appears that WLF is positioning itself to tap into this emerging asset class, which offers opportunities for high returns despite its inherent volatility.

此舉標誌著該公司方法的重大轉變,因為該公司傳統上專注於更傳統的投資工具。然而,隨著加密貨幣的地位不斷提高,WLF 似乎正在將自己定位為進入這一新興資產類別,儘管其固有的波動性,但仍提供了高回報的機會。

The decision to invest in Ethereum, in particular, aligns with broader trends in the financial services industry, where institutional investors are increasingly diversifying their holdings to include cryptocurrencies, especially those with established use cases like Ethereum. Its ability to support decentralized applications (dApps) and smart contracts positions Ethereum as a blockchain with practical, real-world applications, making it an appealing choice for both institutional investors and tech enthusiasts alike.

特別是投資以太坊的決定符合金融服務業的更廣泛趨勢,機構投資者越來越多地多元化持有加密貨幣,尤其是那些具有成熟用例的加密貨幣,例如以太坊。其支持去中心化應用程式 (dApp) 和智慧合約的能力使以太坊成為具有實用、現實世界應用程式的區塊鏈,使其成為機構投資者和技術愛好者的有吸引力的選擇。

Ethereum’s appeal to institutional investors like Trump’s World Liberty Financial is driven by several factors. First, its robust and highly secure blockchain infrastructure supports a wide range of decentralized applications, which are being increasingly adopted across various sectors. This has made Ethereum a key player in the decentralized finance (DeFi) space, allowing for borderless financial transactions and lending services without the need for traditional intermediaries like banks.

以太坊對川普的世界自由金融集團等機構投資者的吸引力是由幾個因素驅動的。首先,其強大且高度安全的區塊鏈基礎設施支援廣泛的去中心化應用程序,這些應用程式正在各個領域中得到越來越多的採用。這使得以太坊成為去中心化金融(DeFi)領域的關鍵參與者,允許無國界金融交易和借貸服務,而無需銀行等傳統中介機構。

Moreover, Ethereum’s transition to a proof-of-stake (PoS) consensus mechanism with the Ethereum 2.0 upgrade is expected to reduce energy consumption, increase transaction speeds, and improve network scalability—features that are highly attractive to institutional investors. As Ethereum becomes more energy-efficient and scalable, its potential for mainstream adoption across financial markets grows, further solidifying its position as a top cryptocurrency.

此外,以太坊2.0升級後向權益證明(PoS)共識機制的過渡預計將減少能源消耗、提高交易速度並提高網路可擴展性,這些功能對機構投資者極具吸引力。隨著以太坊變得更加節能和可擴展,其在金融市場主流採用的潛力不斷增長,進一步鞏固了其作為頂級加密貨幣的地位。

WLF’s $55 million Ethereum acquisition is part of a larger trend where more traditional financial institutions and corporations are stepping into the cryptocurrency arena. Companies such as MicroStrategy, Tesla, and Square have already made sizable Bitcoin investments, while Ethereum’s growing prominence among institutional investors indicates a shift in the way digital assets are viewed by the financial world.

WLF 以 5,500 萬美元收購以太坊是更多傳統金融機構和企業進入加密貨幣領域這一大趨勢的一部分。 MicroStrategy、Tesla 和 Square 等公司已經進行了大量比特幣投資,而以太坊在機構投資者中的地位日益提高,表明金融界看待數位資產的方式發生了轉變。

Furthermore, institutional investors are becoming increasingly comfortable with the regulatory landscape surrounding cryptocurrencies. As governments around the world continue to refine their approaches to cryptocurrency regulation, the confidence of institutional investors has been growing, with many seeing digital assets as a hedge against inflation and currency devaluation, in addition to their potential for high returns.

此外,機構投資者對加密貨幣的監管環境越來越滿意。隨著世界各國政府不斷完善加密貨幣監管方法,機構投資者的信心不斷增強,許多人將數位資產視為對沖通膨和貨幣貶值的工具,此外還具有高回報的潛力。

The decision by Trump’s World Liberty Financial to invest $55 million in Ethereum is a significant development in the ongoing evolution of cryptocurrency as a mainstream investment class. As blockchain technology continues to mature, the role of Ethereum and other digital assets in institutional portfolios will likely grow.

川普的世界自由金融公司決定向以太幣投資 5,500 萬美元,這是加密貨幣作為主流投資類別不斷發展的重大進展。隨著區塊鏈技術的不斷成熟,以太坊和其他數位資產在機構投資組合中的作用可能會增加。

This acquisition also raises questions about the broader implications for the financial sector, as more traditional financial firms look to integrate cryptocurrencies into their offerings. Whether through direct investments or by developing new blockchain-based services, companies like WLF are helping to pave the way for the future of finance, where digital and traditional assets can coexist in a decentralized and efficient manner.

隨著越來越多的傳統金融公司尋求將加密貨幣整合到其產品中,此次收購也引發了對金融業更廣泛影響的質疑。無論是透過直接投資還是開發新的基於區塊鏈的服務,WLF 這樣的公司都在幫助為金融的未來鋪平道路,讓數位資產和傳統資產能夠以去中心化和高效的方式共存。

In conclusion, the $55 million investment in Ethereum by Trump’s World Liberty Financial is a landmark moment that illustrates the increasing integration of cryptocurrencies into the fabric of global finance. As Ethereum continues to evolve and capture the interest of more institutional investors, the future of digital assets looks more promising than ever, signaling a new era of financial innovation and opportunity.

總而言之,川普的世界自由金融公司對以太坊的 5,500 萬美元投資是一個具有里程碑意義的時刻,它說明了加密貨幣日益融入全球金融結構。隨著以太坊不斷發展並吸引更多機構投資者的興趣,數位資產的未來看起來比以往任何時候都更加充滿希望,標誌著金融創新和機會的新時代的到來。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- 燃燒的統計數據說明了一切:

- 2024-12-15 04:45:01

- 目前燃燒率:+515.33% 🚀 燃燒的 SHIB 總量:4103.8 億(總供應量的 41%!)♨️ 24 小時燃燒:14.3 億 SHIB

-

-

-

- 為什麼 $PEPE 即將爆發:Meme 幣革命已經到來!

- 2024-12-15 04:45:01

- PEPE 是一款受人喜愛的迷因幣,靈感來自標誌性的佩佩青蛙,正在加密貨幣市場掀起巨大波瀾!憑藉其強大的社區支持

-

-

-

- Rollblock:精明投資人的更好選擇?

- 2024-12-15 04:45:01

- 圍繞第 2 層平台 Polygon (POL) 和 Arbitrum (ARB) 的最新發展表明,這些網路可能沒有達到預期。

-

- OpenSea 開曼群島註冊助長代幣投機

- 2024-12-15 04:45:01

- 據報道,最大的 NFT 市場之一 OpenSea 已在開曼群島建立了基金會。這項進展引發了猜測